WINNING CHILD CUSTODY UK

THE STRATEGY FOR FATHERS & MOTHERS

Children Welfare Checklist

Section 1 Children Act 1989

Welfare of the child (in England and Wales)

- Welfare of the child is paramount.

- There should not be any delay in determining the upbringing of the child.

The involvement of both parents are important.

This could be direct or indirect. Not necessarily 50:50. - Welfare Checklist

(a) the ascertainable wishes and feelings of the child concerned (considered in the light of his age and understanding);

(b) his physical, emotional and educational needs;

(c) the likely effect on him of any change in his circumstances;

(d) his age, sex, background and any characteristics of his which the court considers relevant;

(e) any harm which he has suffered or is at risk of suffering;

(f) how capable each of his parents, and any other person in relation to whom the court considers the question to be relevant, is of meeting his needs;

(g) the range of powers available to the court under this Act in the proceedings in question.

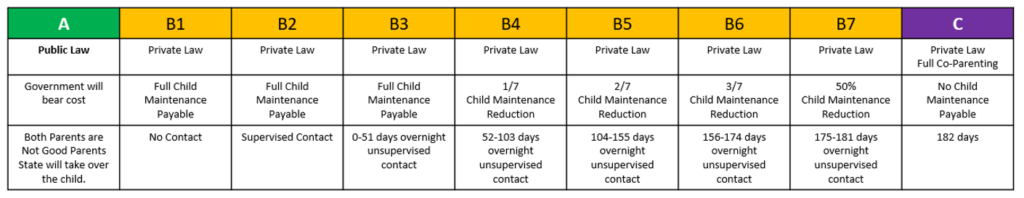

CHILD MAINTENANCE PAYABLE VIA CHILD MAINTENANCE SERVICES (CMS) DEPENDS ON CHILD CONTACT

What is Child Maintenance?

Separated parents are expected to continue paying towards the costs of their children. Often, this means that one parent will pay maintenance costs to the other. You can work out the amount of child maintenance together. Alternatively, if you cannot come to an agreement, you can ask the Child Maintenance Service to calculate it for you.

Arranging child maintenance yourself

If you’re arranging child maintenance privately with your ex-partner, you’re free to work out the amount between you. This is known as a family-based arrangement. Family-based arrangements aren’t legally binding, so, to make it work, both parents must be able to trust each other. But they do offer the flexibility to meet any changing needs and circumstances. You don’t need to involve the Child Maintenance Service if you make a family-based arrangement. But it would be beneficial to check how much your child maintenance would be assessed to be. That way, you can be sure about if your family-based arrangement is fair or not.

You can calculate your child maintenance payments on Calculate your child maintenance – GOV.UK (www.gov.uk)

When you’re working out how much child maintenance you want to pay, you should consider what things you’d like the payments to cover and how you want to pay.

For example:

- Would you like to contribute towards the cost of things like school related costs and extra co-curricular activities?

- Will you pay a regular fixed amount, or vary how much you pay depending on your child’s needs that month? For example, you may want to pay extra if your child goes on a school trip.

- Do you want to pay a certain percentage of your salary? This might be useful if your earnings vary from month to month, such as if you’re self-employed

CHILD MAINTENANCE PAYABLE VIA CHILD MAINTENANCE SERVICES (CMS) DEPENDS ON CHILD CONTACT (Contd.)

How much child maintenance are you expected to pay?

Sometimes, it’s not possible to agree how much one parent should pay the other. While using a mediation service could help you to come to an agreement, the hurt feelings involved when you separate or get divorced can make this difficult. If you can’t agree what your child maintenance payments should be, the Child Maintenance Service can be asked to work it out for you. Unlike family-based arrangements, payments organized through the Child Maintenance Service are legally binding.

The Child Maintenance Service (CMS) will consider:

- The paying parent’s income

- How many children you have together

- How much childcare the paying parent provides

- Whether the paying parent is paying child maintenance to other children from separate relationships

When does child maintenance stop?

You’re expected to keep paying child maintenance until your child is 16. However, child maintenance payments will have to be made until they’re 20 if they’re in full-time education studying for:

- A-levels

- Highers (Scotland)

- An equivalent qualification

How your income affects how much you pay

The Child Maintenance Service (CMS) calculates child maintenance payments by applying a specific rate to your gross weekly income. That’s how much money you receive before you pay things like tax and National Insurance contributions.

The child maintenance rates are:

- Basic rate

- Reduced rate

- Flat rate

- Nil rate

CHILD MAINTENANCE PAYABLE VIA CHILD MAINTENANCE SERVICES (CMS) DEPENDS ON CHILD CONTACT (Contd.)

Basic rate

You’ll be placed on the basic rate if your gross weekly income is between £200 and £3,000. The percentage of your income is dependent upon how many children you’re responsible for and the amount of childcare that you provide. Assuming that you’re responsible for one child, your child maintenance payments would be 12% of your gross weekly income.

Reduced rate

A gross weekly income of more than £100 but less than £200 will put you on the reduced rate. You’ll pay a standard weekly rate of £7 on your first £100, plus an additional percentage of the rest of your income. Assuming that you’re responsible for one child, you’ll pay £7 on your first £100, plus 17% of your remaining gross weekly income.

Flat rate

A flat rate of £7 will be applied if you’re on benefits or your gross weekly income is below £100. Nil rate

You don’t need to pay any child maintenance if your gross weekly income is less than £7.

How the number of children you have affects how much you pay

The number of children you have with your ex-partner will increase how much child maintenance you need to pay.

Assuming you’re on the basic rate, you’ll need to pay:

- 12% of your gross weekly income for one child

- 16% of your gross weekly income for two children

- 19% of your gross weekly income for three or more children

If you’re on the reduced rate, you’ll pay a standard weekly payment of £7 on the first £100 of your income, plus a percentage of your remaining gross weekly income up to £200:

- 17% of your remaining gross weekly income for one child

- 25% of your remaining gross weekly income for two children

- 31% of your remaining gross weekly income for three or more children

CHILD MAINTENANCE PAYABLE VIA CHILD MAINTENANCE SERVICES (CMS) DEPENDS ON CHILD CONTACT (Contd.)

How shared parenting affects child maintenance

After you separate, you’ll probably share taking care of your children with your ex-partner. Your children’s living arrangements are up to you. But one parent will typically be responsible for the children most of the time. If you’re the paying parent, you’ll pay less child maintenance if you look after your children for a certain amount of time. Child maintenance is reduced for each child depending on the number of nights you spend with them. Over the course of a year, if you look after your children between:

- 52 – 103 nights: child maintenance is reduced by 1/7th for each child

- 104 – 155 nights: child maintenance is reduced by 2/7ths for each child

- 156 – 174 nights: child maintenance is reduced by 3/7ths for each child

175 nights or more: child maintenance is reduced by 50%, with a further reduction of £7 for each child

Supporting children from another relationship

If the paying parent is supporting children from another relationship, and their gross weekly income is between £200 and £3000, the weekly income considered by the Child Maintenance Service will be reduced in their calculations.

If you’re paying for:

- One other child, your considered income will be reduced by 11%

- Two other children, your considered income will be reduced by 14%

- Three or more children, your considered income will be reduced by 16%

Join our mailing list

If you are interested in receiving newsletters and information about upcoming events from us, then please leave your email address below: